Bernard Arnault Full Q&A (Oxford Union)

Bernard Arnault is the Chairman and CEO of the world’s largest and most successful luxury goods conglomerate, LVMH, which controls brands such as Louis Vuitton, Fendi, TAG Heuer, Bulgari and Marc Jacobs. While growing LVMH’s portfolio of prestigious brands at a staggering pace, Arnault made notable investments in companies such as Netflix over ten years ago. In March 2015, Forbes estimated him to be the world’s thirteenth richest person.

Jamie Dimon’s 2015 Letter (JPM)

Related: Brooklyn Investor commentary

Jeff Bezos 2015 Letter (Amazon)

Sam Hinkie’s Letter – Thinking about thinking (ValueWalk)

Probably the longest ever resignation letter.

Semper Augustus Investments Group: 2015 Annual Letter (Value Investing World)

Grant's Spring Conference Notes 2016 - Bessent, Dimon & More (Market Folly)

Russia - a forgotten market? (East Capital)

Djibouti Is Hot (Bloomberg)

How a forgotten sandlot of a country became a hub of international power games.

Rising in the East (60 Minutes)

China's film industry has grown so big so fast, that it is now looking to compete with Hollywood.

This is fascinating - The brain on LSD revealed: first scans show how the drug affects the brain (Imperial College London)

"Our brains become more constrained and compartmentalised as we develop from infancy into adulthood, and we may become more focused and rigid in our thinking as we mature. In many ways, the brain in the LSD state resembles the state our brains were in when we were infants: free and unconstrained. This also makes sense when we consider the hyper-emotional and imaginative nature of an infant's mind."

The sugar conspiracy (Guardian)

In 1972, a British scientist sounded the alarm that sugar – and not fat – was the greatest danger to our health. But his findings were ridiculed and his reputation ruined. How did the world’s top nutrition scientists get it so wrong for so long?

Saturday 16 April 2016

Sunday 3 April 2016

Some Thoughts on Minor International

Minor (MINT:TB) is a Thai listed hotel and food business operator with an excellent track record. I’ve been keeping track of the stock for the last few years mostly as a spectator, for which I’ve been kicking myself but that’s beside the point. The company was formed in the late 1970s by an American businessman (now Thai citizen) Bill Heinecke, who took a $1,200 loan and over time turned it into MINT. As a fun fact, the company is called Minor as Mr Heinecke (who owns 33%, c. $1.5bn value) was still a minor when he founded it. While he is relatively unknown outside of Thailand/SE Asia his story is pretty remarkable. After the write up there are a few links to profiles, interviews and he also has a good book about entrepreneurship that I recommend reading.

History

MINT consists of three businesses: hotel (51% of revenue), food (41% of revenue) and retail (8%) and prior to two corporate restructurings operated with three separately listed entities, coupled with cross-holdings in true Asian conglomerate style (see structure below):

The first of the consolidations was in 2005 when MINT closed the acquisition process of MFG it started in 2001 (MFG’s results have been consolidated since 2004), which lead to the re-branding of RGR to MINT in 2005. Then in the middle of the financial crisis MINT announced that it planned to acquire Minor Corp and unwind the cross-holdings in an all-share deal. Following these restructurings, MINT now houses all three businesses and Mr Heinecke, who is the chairman and CEO, and his group owns 33% of the company. Below is a summary of MINT’s major moves over its history to date.

Source: Company filings

MINT has been a clear beneficiary of smart capital allocation as well as the growth in SE Asia. Since 2005 to date the share price compounded c. 24% (TSR in THB); revenue and EBITDA grew 16% p.a. and 14% p.a., respectively; while ROIC averaged 18%. Current market cap is $4.6bn (EV $5.8bn) and trades on forward EBITDA of 18x and PE of 26x, respectively so it is hard to call the stock cheap statistically.

Source: Bloomberg. Share price and TSR (THB)

Businesses

What’s key for MINT are the brands it built around the hotel, food and retail businesses over the last 20+ years. Essentially these avenues allow mgmt. to reinvest capital at very high rates, with the added benefit that some of these brands “travel”. Oftentimes you find a brand, such as Tingyi’s Master Kong in China, which is the dominant one in the country but doesn’t travel well outside of the country thus the company is restricted to its home market. Now you could argue that when you rule the noodle empire in China, why would you want to go elsewhere. If the company in question is based in a smaller market or country which is saturated, expansion and brands that travel i.e. having some form of a platform, becomes very important. MINT has historically partnered with leading global brands (see Pizza Hut, Four Seasons etc) but has never been shy to apply lessons learnt from these partnerships to develop their own businesses over time (e.g. Pizza Co or Anantara). The other interesting part is that generally speaking MINT’s existing and new investments are in countries along the new Maritime Road (from China’s OBOR), which is taking everything at face value is not a terrible thing.

Hotel Business

The hotel business (previously RGR) started with one hotel in Thailand. As of 2015 it has 138 properties and over 17,000 rooms (inc. majority owned, JVs and management letting rights and managed) globally. Over the last few years this business contributed 50% to revenues and 60% to EBITDA on average.

Source: Company filings

MINT follows an “asset-right” strategy, which is a combination of direct hotel ownership as well as management contracts. Generally speaking, when the company enters a new market it starts out with management contracts to establish itself. Once it feels more comfortable, it would form a JV with a local partner and then finally own the assets outright. This is the strategy the company followed when the balance sheet was fairly levered before or when it recently entered Africa.

Source: Company filings

Of the existing 138 properties, 30 are purely managed, 49 are under management letting rights (Oaks business, serviced suites in Australia and New Zealand), 30 are in different JVs while 29 are majority owned.

The majority owned hotels contribute 45% to revenues, with nearly 5,400 rooms globally with brands such as Anantara (developed by MINT), Four Seasons, Marriott or St Regis. The most recent addition to the portfolio was Tivoli (hotel operator in Portugal and Brazil with 4-5 star properties). MINT acquired the business to use it as a platform to expand in Europe, LatAm and certain parts of Africa. The acquisition price was €290m or $330m for 2,982 rooms ($110k/key on average) or 9.6x EBITDA (MINT notes normalised 2015 EBITDA of €30m), which is neither expensive nor cheap. Local contacts confirm that the hotels are very good but nothing out of the ordinary.

The Oaks business (management letting rights) contributes 25% to revenues and is a business MINT acquired in 2011 in a bid to increase the company’s asset-light earnings stream. Oaks was under financial stress at the time due to leverage so the purchase was rather opportunistic. The all-in price was around $95m with 2011 EBITDA guidance of $35-40m. Since 2012 (first full year of consolidation) revenues increased c. 50% through 2015. The business now includes over 6,200 rooms in Australia, New Zealand and UAE.

Real estate business (Anantara Vacation Club and residential sales) add c. 20% to revenues and include the development of properties either for sale (the residential part) or a timeshare/lifestyle club (AVC). Currently, AVC has 6,900 members (majority from China) and 137 units in inventory.

Hotel management and JVs contribute around 5% to revenues each on average and include around 30 hotels (over 3,900 rooms) and 30 hotels (over 1,200 rooms), respectively.

The below slide gives an overview of the expansion plans, additionally the company plans to invest to increase it’s residential as well as AVC inventory.

Source: Company filings

Food Business

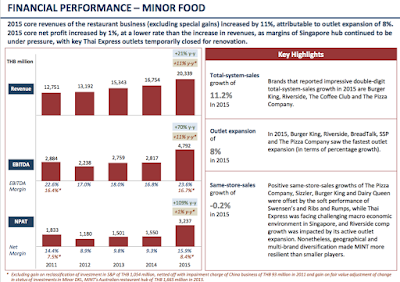

As noted above the food business has been consolidated since 2005 and it contributes c. 40% to revenues and 30% to EBITDA on average. It is a more stable business and acts as the cash cow to fund the hotel/real estate growth. It includes over 20 brands (The Pizza Co, Sizzler, BK, DQ, Thai Express etc) and over 1,800 restaurants that are either owned or franchised (roughly 50/50). In fact, MINT was one of the first companies in Thailand to introduce the QSR concept. Since 2005 segment revenues increased 4x and the company operates in four hubs: Thailand, Singapore, Australia and China. The below two charts give a good glimpse as to what’s in this business. MINT plans to increase the restaurant count by 70% from 2015 through 2020. While segment revenues have grown over the years due to the expansion of outlets the concerning part is the declining SSSG.

Source: Company filings

Source: Company filings

Last but not least the retail business is about 9% of revenues and 3% of EBITDA on average, and includes retail outlets with brands such as the Gap, Espirit, Bossini as well as contract manufacturing of FMCG. As of 2015 the business has 269 fashion, 16 cosmetic and 22 household outlets.

Financials

Below is a selection of key financials for your perusal but I’d bring your attention to a few items:

Valuation

MINT is currently going through a transformation and growth phase (some say it has never been on a different one) both in its businesses as it focuses on organic growth as well as M&A, diversifying further away from its base in Thailand. Per the company’s estimate this should translate to 15-20% average p.a. growth in net income over the next five years with ROIC of over 15%.

Source: Company filings

I’m not a big fan of five year plans, mostly for the reason that nobody knows what will happen by year five and from experience with boards and managements these plans are by and large missed. What I look at instead is track record – how did a company do in various economic and political scenarios. It tells a lot about management’s ability and the company’s resilience. For MINT, given the volatility of Thailand (plenty of coups for a relatively peaceful country) it is rather easy to see. While one-off events have impacted results the company has grown right through them over the long term.

Source: Company filings

As noted above the multiples are quite rich and the highest they have ever been, well above their historical average levels. In fact, a large part of the share price performance was driven by the re-rating of the multiples which you can see below.

Source: Bloomberg

Source: Bloomberg

While I rarely come across formal guidance from Asian listed businesses, the below two charts are as far as I’ve see any go. MINT is essentially saying that their plan (and again note the above caveat) is to increase the 2015 THB7bn net income (note it includes a large write-up) by call it 80-100% over the next five years (it’s roughly a 15% CAGR).

Source: Company filings

Additionally, the chart below shows MINT’s capex requirements (the bars) and EBITDA coverage. If you take the 2020 committed capex of around THB5.5bn and the guided coverage of 4x, it would imply THB22bn EBITDA vs the THB11bn in 2015 (i.e. the same sort of growth rate as net income).

If you put the forward P/E and EBITDA multiples on these figures, assume no further dilution and discount it today, the per share value could be around THB55-60 or 50-60% higher than compared to current.

Another way to look at it is to run cash flows with different growth rates. At present I believe the market is pricing an 8-9% p.a. increase in EBITDA and FCF vs the 15% p.a. as above so you’ve a range for the valuation and what you believe the appropriate growth rate is. MINT is arguably one of the best compounding machines around but I’d say that to get to their valuation range many things have to go right in terms of timing and execution. It is not far-fetched at all (judging by track record) and if one believes in the “platform” value of MINT, i.e. the multiples of avenues for reinvestment, which has been historically demonstrated, it is certainly plausible.

I’ve been thinking about what’s the genius of Mr Heinecke. He doesn’t strike me as an “outsider” type from a financial engineering or capital allocation perspective but more so as a brand builder or entrepreneur (like Mr Branson less the hot air balloons). Mr Heinecke has been a clear beneficiary of the EM growth (particularly Thailand) but also had the savvy to build out these great platforms (sometimes opportunistically) with solid brands.

Alternative Ways of Investing in MINT

MINT is primarily traded in Thailand and there are a few illiquid ADRs here and there but largely not worth your time. If you looked carefully at the list of shareholders you’ll find that a large chunk of shares are held by Symphony International (SIHL). I wrote about this stock briefly a while ago but thought it would be worthwhile to circle back.

SIHL is a closed end fund listed in London, with its largest holding as MINT. They hold an 8% stake ($350m value), while the key person behind SIHL/chairman of the GP is also on the board of MINT. As of December 2015 the SIHL NAV is around $700m so clearly MINT is a substantial holding for the fund. Diluted NAV per share is $1.3 per share (shares trade in $); listed investments make up $0.9/sh, unlisted investments c. $0.3/sh with $0.1/sh in temporary investments, trading at an approx. 40% discount to NAV (not terribly different from historicals). Now for the famous “what are you getting for free”: if you back out the unlisted investments and cash you are still getting the listed investments at a discount.

But it begs the question why is there such a discount? To put this into context: SIHL went public in 2007 at $1/sh while the current price is $0.75/sh…clearly a very different story compared to MINT. I wrote about the reasons in the past but it’ll be a combination of the management fees, capital allocation, ill-timed rights issue, substantial options granted to the manager and limited inclination to do anything about the discount. On the upside there are the 2017 clause to distribute 80% of the NAV as well as a few large shareholders who have been active and could be further catalysts for the closing of the discount.

Further Resources

Bill Heinecke Amazon Author Page

DealBook Profile

Bloomberg Profile

Bloomberg Video Interview

CNBC Video Interview

Investor Q&A after the 2014 Results

MINT 2015 IR Presentation

SIHL's Investments

SIHL’s 2015 Annual Report

History

MINT consists of three businesses: hotel (51% of revenue), food (41% of revenue) and retail (8%) and prior to two corporate restructurings operated with three separately listed entities, coupled with cross-holdings in true Asian conglomerate style (see structure below):

- Royal Garden Resorts (Minor International since 2005) was founded in 1978 with one hotel on the Pattaya beachfront (now Pattaya Mariott Resort & Spa) and listed in 1988

- Minor Food Group (MFG) was founded in 1980, with one Pizza Hut. This business grew to introduce other Western franchise concepts in Thailand (Swensen, Sizzler, BK, Dairy Queen and so on). Ultimately, Minor lost the Pizza Hut franchise and in “retaliation” formed the Pizza Company (now it’s a larger franchise in the country than Pizza Hut)

- Minor Corp, which houses the retail business (stores of Espirit, Gap, Tumi etc) in Thailand, was listed in 1991

Source: Company filings

MINT has been a clear beneficiary of smart capital allocation as well as the growth in SE Asia. Since 2005 to date the share price compounded c. 24% (TSR in THB); revenue and EBITDA grew 16% p.a. and 14% p.a., respectively; while ROIC averaged 18%. Current market cap is $4.6bn (EV $5.8bn) and trades on forward EBITDA of 18x and PE of 26x, respectively so it is hard to call the stock cheap statistically.

Source: Bloomberg. Share price and TSR (THB)

Businesses

What’s key for MINT are the brands it built around the hotel, food and retail businesses over the last 20+ years. Essentially these avenues allow mgmt. to reinvest capital at very high rates, with the added benefit that some of these brands “travel”. Oftentimes you find a brand, such as Tingyi’s Master Kong in China, which is the dominant one in the country but doesn’t travel well outside of the country thus the company is restricted to its home market. Now you could argue that when you rule the noodle empire in China, why would you want to go elsewhere. If the company in question is based in a smaller market or country which is saturated, expansion and brands that travel i.e. having some form of a platform, becomes very important. MINT has historically partnered with leading global brands (see Pizza Hut, Four Seasons etc) but has never been shy to apply lessons learnt from these partnerships to develop their own businesses over time (e.g. Pizza Co or Anantara). The other interesting part is that generally speaking MINT’s existing and new investments are in countries along the new Maritime Road (from China’s OBOR), which is taking everything at face value is not a terrible thing.

Hotel Business

The hotel business (previously RGR) started with one hotel in Thailand. As of 2015 it has 138 properties and over 17,000 rooms (inc. majority owned, JVs and management letting rights and managed) globally. Over the last few years this business contributed 50% to revenues and 60% to EBITDA on average.

Source: Company filings

MINT follows an “asset-right” strategy, which is a combination of direct hotel ownership as well as management contracts. Generally speaking, when the company enters a new market it starts out with management contracts to establish itself. Once it feels more comfortable, it would form a JV with a local partner and then finally own the assets outright. This is the strategy the company followed when the balance sheet was fairly levered before or when it recently entered Africa.

Source: Company filings

Of the existing 138 properties, 30 are purely managed, 49 are under management letting rights (Oaks business, serviced suites in Australia and New Zealand), 30 are in different JVs while 29 are majority owned.

The majority owned hotels contribute 45% to revenues, with nearly 5,400 rooms globally with brands such as Anantara (developed by MINT), Four Seasons, Marriott or St Regis. The most recent addition to the portfolio was Tivoli (hotel operator in Portugal and Brazil with 4-5 star properties). MINT acquired the business to use it as a platform to expand in Europe, LatAm and certain parts of Africa. The acquisition price was €290m or $330m for 2,982 rooms ($110k/key on average) or 9.6x EBITDA (MINT notes normalised 2015 EBITDA of €30m), which is neither expensive nor cheap. Local contacts confirm that the hotels are very good but nothing out of the ordinary.

The Oaks business (management letting rights) contributes 25% to revenues and is a business MINT acquired in 2011 in a bid to increase the company’s asset-light earnings stream. Oaks was under financial stress at the time due to leverage so the purchase was rather opportunistic. The all-in price was around $95m with 2011 EBITDA guidance of $35-40m. Since 2012 (first full year of consolidation) revenues increased c. 50% through 2015. The business now includes over 6,200 rooms in Australia, New Zealand and UAE.

Real estate business (Anantara Vacation Club and residential sales) add c. 20% to revenues and include the development of properties either for sale (the residential part) or a timeshare/lifestyle club (AVC). Currently, AVC has 6,900 members (majority from China) and 137 units in inventory.

Hotel management and JVs contribute around 5% to revenues each on average and include around 30 hotels (over 3,900 rooms) and 30 hotels (over 1,200 rooms), respectively.

The below slide gives an overview of the expansion plans, additionally the company plans to invest to increase it’s residential as well as AVC inventory.

Source: Company filings

Food Business

As noted above the food business has been consolidated since 2005 and it contributes c. 40% to revenues and 30% to EBITDA on average. It is a more stable business and acts as the cash cow to fund the hotel/real estate growth. It includes over 20 brands (The Pizza Co, Sizzler, BK, DQ, Thai Express etc) and over 1,800 restaurants that are either owned or franchised (roughly 50/50). In fact, MINT was one of the first companies in Thailand to introduce the QSR concept. Since 2005 segment revenues increased 4x and the company operates in four hubs: Thailand, Singapore, Australia and China. The below two charts give a good glimpse as to what’s in this business. MINT plans to increase the restaurant count by 70% from 2015 through 2020. While segment revenues have grown over the years due to the expansion of outlets the concerning part is the declining SSSG.

Source: Company filings

Source: Company filings

Last but not least the retail business is about 9% of revenues and 3% of EBITDA on average, and includes retail outlets with brands such as the Gap, Espirit, Bossini as well as contract manufacturing of FMCG. As of 2015 the business has 269 fashion, 16 cosmetic and 22 household outlets.

Financials

Below is a selection of key financials for your perusal but I’d bring your attention to a few items:

- Leverage: It’s high. Currently net debt/EBITDA and EBIT are around 4x and 5.5x with the average over the period being approx. 1x lower. This is the result of the breakneck speed growth. While it’s high it is not unmanageable and if the company stopped investing in growth it could technically begin to repay it

- Share count: The reason while leverage is not higher is due to share issuance over the years. Since 2005 the diluted share count increased by 5% p.a., due to issuance for M&A, options, stock dividends (most recently in 2015) or warrants. While net income increased 21% p.a., EPS increased by “only” 15% p.a. as result of dilution

- Free cash flow: MINT has been largely free cash flow positive only including investment in PPE. Accounting for additional investments and M&A the picture is slightly different. However, have to say that looking at the history (e.g. Oaks) most of them turned out to be accretive investments

- Dividend: MINT paid out roughly 35% of net income as dividend (either cash or in-kind), while DPS compounded 11% over the years. The current yield is about 1%

- Margins: Net, EBIT and EBITDA margins averaged 11%, 15% and 23% over the last ten years and generally speaking have been relatively stable

- Returns: ROIC averaged 18% and you can see a recovery from 2011 onwards due to a shift towards a more balanced “asset-right” strategy

Source: Company filings. Dividend payout refers to average payout

Valuation

MINT is currently going through a transformation and growth phase (some say it has never been on a different one) both in its businesses as it focuses on organic growth as well as M&A, diversifying further away from its base in Thailand. Per the company’s estimate this should translate to 15-20% average p.a. growth in net income over the next five years with ROIC of over 15%.

Source: Company filings

I’m not a big fan of five year plans, mostly for the reason that nobody knows what will happen by year five and from experience with boards and managements these plans are by and large missed. What I look at instead is track record – how did a company do in various economic and political scenarios. It tells a lot about management’s ability and the company’s resilience. For MINT, given the volatility of Thailand (plenty of coups for a relatively peaceful country) it is rather easy to see. While one-off events have impacted results the company has grown right through them over the long term.

Source: Company filings

As noted above the multiples are quite rich and the highest they have ever been, well above their historical average levels. In fact, a large part of the share price performance was driven by the re-rating of the multiples which you can see below.

Source: Bloomberg

Source: Bloomberg

While I rarely come across formal guidance from Asian listed businesses, the below two charts are as far as I’ve see any go. MINT is essentially saying that their plan (and again note the above caveat) is to increase the 2015 THB7bn net income (note it includes a large write-up) by call it 80-100% over the next five years (it’s roughly a 15% CAGR).

Source: Company filings

Additionally, the chart below shows MINT’s capex requirements (the bars) and EBITDA coverage. If you take the 2020 committed capex of around THB5.5bn and the guided coverage of 4x, it would imply THB22bn EBITDA vs the THB11bn in 2015 (i.e. the same sort of growth rate as net income).

If you put the forward P/E and EBITDA multiples on these figures, assume no further dilution and discount it today, the per share value could be around THB55-60 or 50-60% higher than compared to current.

Source: Company filings

Another way to look at it is to run cash flows with different growth rates. At present I believe the market is pricing an 8-9% p.a. increase in EBITDA and FCF vs the 15% p.a. as above so you’ve a range for the valuation and what you believe the appropriate growth rate is. MINT is arguably one of the best compounding machines around but I’d say that to get to their valuation range many things have to go right in terms of timing and execution. It is not far-fetched at all (judging by track record) and if one believes in the “platform” value of MINT, i.e. the multiples of avenues for reinvestment, which has been historically demonstrated, it is certainly plausible.

I’ve been thinking about what’s the genius of Mr Heinecke. He doesn’t strike me as an “outsider” type from a financial engineering or capital allocation perspective but more so as a brand builder or entrepreneur (like Mr Branson less the hot air balloons). Mr Heinecke has been a clear beneficiary of the EM growth (particularly Thailand) but also had the savvy to build out these great platforms (sometimes opportunistically) with solid brands.

Alternative Ways of Investing in MINT

MINT is primarily traded in Thailand and there are a few illiquid ADRs here and there but largely not worth your time. If you looked carefully at the list of shareholders you’ll find that a large chunk of shares are held by Symphony International (SIHL). I wrote about this stock briefly a while ago but thought it would be worthwhile to circle back.

SIHL is a closed end fund listed in London, with its largest holding as MINT. They hold an 8% stake ($350m value), while the key person behind SIHL/chairman of the GP is also on the board of MINT. As of December 2015 the SIHL NAV is around $700m so clearly MINT is a substantial holding for the fund. Diluted NAV per share is $1.3 per share (shares trade in $); listed investments make up $0.9/sh, unlisted investments c. $0.3/sh with $0.1/sh in temporary investments, trading at an approx. 40% discount to NAV (not terribly different from historicals). Now for the famous “what are you getting for free”: if you back out the unlisted investments and cash you are still getting the listed investments at a discount.

But it begs the question why is there such a discount? To put this into context: SIHL went public in 2007 at $1/sh while the current price is $0.75/sh…clearly a very different story compared to MINT. I wrote about the reasons in the past but it’ll be a combination of the management fees, capital allocation, ill-timed rights issue, substantial options granted to the manager and limited inclination to do anything about the discount. On the upside there are the 2017 clause to distribute 80% of the NAV as well as a few large shareholders who have been active and could be further catalysts for the closing of the discount.

Further Resources

Bill Heinecke Amazon Author Page

DealBook Profile

Bloomberg Profile

Bloomberg Video Interview

CNBC Video Interview

Investor Q&A after the 2014 Results

MINT 2015 IR Presentation

SIHL's Investments

SIHL’s 2015 Annual Report

Weekend reading

Never thought I’d read this in Variety - John Malone: ‘Cable Cowboy’ Faces the Test in Rounding Up the Right Mix of Assets (Variety)

Baijiu: the people’s tipple (FT)

China wants to make its national spirit its next big global export — but there are obstacles

Eiichi Shibusawa - The Father of Modern Capitalism in Japan (Undervalued Japan)

ADVICE FROM HEDGE FUND MANAGER – EDWARD MISRAHI (What I Learnt on Wall Street)

Templeton’s Emerging Markets Guru Mark Mobius Steps Down (Barron's Asia)

Can Sequoia Recover From Its Valeant Stake? (Morningstar)

An Approach to Long-Term Investing in Asia - Koon Boon Kee of The Moat Report Asia (Manual of Ideas)

A Dozen Things I’ve Learned from Chamath Palihapitiya About Investing and Business (25iq)

The Secret to Tony Robbins’ 38 Years of Success (Early to Rise)

This is powerful: "I always tell people — Life supports what supports more life. If you’re trying to support yourself, you’re going to get a certain level of insights. If you’re trying to support your family, you’re going to get a different level of insights. If you’re trying to support your community or humanity, you get insights most people never dream of. That’s really been the secret to my 38 years because those are my real goals."

How People Learn to Become Resilient (New Yorker)

Umberto Eco’s Antilibrary: Why Unread Books Are More Valuable to Our Lives than Read Ones (Brain Pickings)

I got library envy - Why every home should have a library and six examples for sale (FT)

Life’s Work: An Interview with Kevin Spacey (HBR)

It’s incredible to help young people find their own self-esteem and voice and learn collaborative skills. But it’s funny: When you tell them something that’s been passed down to you, some lesson you learned a long time ago, often, in the act of saying it, you think, “Oh, my God. I needed to hear that. It’s really important, and I haven’t been doing it myself.”

Getting to Si, Ja, Oui, Hai, and Da (HBR)

Adam Grant The surprising habits of original thinkers (TED)

WAYNE SHORTER & HERBIE HANCOCK PEN AN OPEN LETTER TO THE NEXT GENERATION OF ARTISTS (Nest HQ)

We’d like to be clear that while this letter is written with an artistic audience in mind, these thoughts transcend professional boundaries and apply to all people, regardless of profession.

While it’s true that the issues facing the world are complex, the answer to peace is simple; it begins with you. You don’t have to be living in a third world country or working for an NGO to make a difference. Each of us has a unique mission. We are all pieces in a giant, fluid puzzle, where the smallest of actions by one puzzle piece profoundly affects each of the others. You matter, your actions matter, your art matters.

If you are into music, highly recommend the following video - Pharrell Williams Masterclass with Students at NYU Clive Davis Institute (YouTube)

Baijiu: the people’s tipple (FT)

China wants to make its national spirit its next big global export — but there are obstacles

Eiichi Shibusawa - The Father of Modern Capitalism in Japan (Undervalued Japan)

ADVICE FROM HEDGE FUND MANAGER – EDWARD MISRAHI (What I Learnt on Wall Street)

Templeton’s Emerging Markets Guru Mark Mobius Steps Down (Barron's Asia)

Can Sequoia Recover From Its Valeant Stake? (Morningstar)

An Approach to Long-Term Investing in Asia - Koon Boon Kee of The Moat Report Asia (Manual of Ideas)

A Dozen Things I’ve Learned from Chamath Palihapitiya About Investing and Business (25iq)

The Secret to Tony Robbins’ 38 Years of Success (Early to Rise)

This is powerful: "I always tell people — Life supports what supports more life. If you’re trying to support yourself, you’re going to get a certain level of insights. If you’re trying to support your family, you’re going to get a different level of insights. If you’re trying to support your community or humanity, you get insights most people never dream of. That’s really been the secret to my 38 years because those are my real goals."

How People Learn to Become Resilient (New Yorker)

Umberto Eco’s Antilibrary: Why Unread Books Are More Valuable to Our Lives than Read Ones (Brain Pickings)

I got library envy - Why every home should have a library and six examples for sale (FT)

Life’s Work: An Interview with Kevin Spacey (HBR)

It’s incredible to help young people find their own self-esteem and voice and learn collaborative skills. But it’s funny: When you tell them something that’s been passed down to you, some lesson you learned a long time ago, often, in the act of saying it, you think, “Oh, my God. I needed to hear that. It’s really important, and I haven’t been doing it myself.”

Getting to Si, Ja, Oui, Hai, and Da (HBR)

Adam Grant The surprising habits of original thinkers (TED)

WAYNE SHORTER & HERBIE HANCOCK PEN AN OPEN LETTER TO THE NEXT GENERATION OF ARTISTS (Nest HQ)

We’d like to be clear that while this letter is written with an artistic audience in mind, these thoughts transcend professional boundaries and apply to all people, regardless of profession.

While it’s true that the issues facing the world are complex, the answer to peace is simple; it begins with you. You don’t have to be living in a third world country or working for an NGO to make a difference. Each of us has a unique mission. We are all pieces in a giant, fluid puzzle, where the smallest of actions by one puzzle piece profoundly affects each of the others. You matter, your actions matter, your art matters.

If you are into music, highly recommend the following video - Pharrell Williams Masterclass with Students at NYU Clive Davis Institute (YouTube)

Saturday 5 March 2016

Andre Kostolany, bon vivant and speculator

“When the golden boys of Wall Street return to selling vacuum cleaners the world will be a much better place” - Andre Kostolany

It’s hard to top that line. A few weeks ago Andre Kostolany would have celebrated his 110th birthday. His books on the markets are one of my favourite reads as he writes with such clarity and humour that they are almost page turners (as far as finance books go). He wasn’t a value investor or a "fundamentalist" rather a true contrarian and speculator but somehow buying securities below intrinsic worth was inherent in his style. He often relied on his imagination or the “story” part to make an investment case vs running cash flow models. He said that “success on the stock market is an art and not a science”. The reason I really enjoy his writings is due to the historical perspective. Speculating in German government bonds in the 1940s, yes he has done it; being short in 1929, tick that box; speculating in wool in the 1940s, likewise. It’s very rare to read or listen to someone with 70+ years investing experience, and investing is a subject where experience is certainly important. Combined with his stories of famous bankers, investors, writers, musicians and witty one liners it’s no wonder his books (10+) sold millions of copies all over the world. But it’s unlikely that you’d have heard about him unless you live in continental Europe.

It’s hard to top that line. A few weeks ago Andre Kostolany would have celebrated his 110th birthday. His books on the markets are one of my favourite reads as he writes with such clarity and humour that they are almost page turners (as far as finance books go). He wasn’t a value investor or a "fundamentalist" rather a true contrarian and speculator but somehow buying securities below intrinsic worth was inherent in his style. He often relied on his imagination or the “story” part to make an investment case vs running cash flow models. He said that “success on the stock market is an art and not a science”. The reason I really enjoy his writings is due to the historical perspective. Speculating in German government bonds in the 1940s, yes he has done it; being short in 1929, tick that box; speculating in wool in the 1940s, likewise. It’s very rare to read or listen to someone with 70+ years investing experience, and investing is a subject where experience is certainly important. Combined with his stories of famous bankers, investors, writers, musicians and witty one liners it’s no wonder his books (10+) sold millions of copies all over the world. But it’s unlikely that you’d have heard about him unless you live in continental Europe.

Andre Kostolany was born in 1906 to an industrialist family in Budapest, Hungary as the youngest of four children. His family was very well known in the country and was close to Edward Teller or the Zwack family in Hungary to name a few. He studied philosophy and art history until one day one of his father’s investor friends based in Paris asked his father without any pretentiousness:“what would you like that child to become? A poet?! Send him to my office for real world experience, he'll learn a lot more". Andre Kostolany admitted that he was right. That’s how he moved to Paris, fell in love with the markets and began his life as a speculator. He has experienced a huge amount of volatility - successes and failures - and got wiped out on occasions early in his career, only to be bailed out by friends and associates. He chalked these lessons down to experience. One of the early lessons he learnt in the markets was basic supply and demand: “in the markets what matters is the relative size of the supply of paper [securities] to fools”.

Following the German invasion in 1940 he left Paris for New York, where he was based for the next 10 years. Prior to his escape he was asked about his political leaning and was often quoted saying that “my brain is to the right, my heart is to the left but my money is already in the US” [approx. $200k, which is a few $m in today's worth]. In the US he became the head and key shareholder of an investment company (Ballai and Cie Financing Company). After his time in the US he returned to Paris where he met his wife and settled down, although never had children. He was getting restless about the next steps of his life and upon the advice of a psychologist he began writing books on investing, markets, economics and personal anecdotes collected over a lifetime. I believe his published book count is well over 10 but none in English to my knowledge unfortunately (mostly in European and some Asian languages). He took on a major "celebrity status" after publishing his regular newspaper column (over 400 articles) in the German “Capital” magazine. He often appeared in German TV shows discussing current economic and market topics (watch from 5.40min mark for his definition of a crash). Kostolany split his time between Paris, Munich and the Cote d’Azur. To add to his many accomplishments he also founded a German investment company that is still around today.

His last wish was to be able to write the first article in the January 2000 edition of the Capital magazine. Unfortunately after a very long and colourful life he passed away in September 1999 at the age of 93 (you can read his obituary here). There is a very nice TV ad, which was shot in Budapest where he appears in. It’s a short video with an important life lesson at the end. Highly recommended to watch.

I’ve summarised some thoughts he had on investing, markets, economics and psychology and so on that I thought were interesting. You'll see that many of his views are actually very close to famous value investors':

It’s hard to top that line. A few weeks ago Andre Kostolany would have celebrated his 110th birthday. His books on the markets are one of my favourite reads as he writes with such clarity and humour that they are almost page turners (as far as finance books go). He wasn’t a value investor or a "fundamentalist" rather a true contrarian and speculator but somehow buying securities below intrinsic worth was inherent in his style. He often relied on his imagination or the “story” part to make an investment case vs running cash flow models. He said that “success on the stock market is an art and not a science”. The reason I really enjoy his writings is due to the historical perspective. Speculating in German government bonds in the 1940s, yes he has done it; being short in 1929, tick that box; speculating in wool in the 1940s, likewise. It’s very rare to read or listen to someone with 70+ years investing experience, and investing is a subject where experience is certainly important. Combined with his stories of famous bankers, investors, writers, musicians and witty one liners it’s no wonder his books (10+) sold millions of copies all over the world. But it’s unlikely that you’d have heard about him unless you live in continental Europe.

It’s hard to top that line. A few weeks ago Andre Kostolany would have celebrated his 110th birthday. His books on the markets are one of my favourite reads as he writes with such clarity and humour that they are almost page turners (as far as finance books go). He wasn’t a value investor or a "fundamentalist" rather a true contrarian and speculator but somehow buying securities below intrinsic worth was inherent in his style. He often relied on his imagination or the “story” part to make an investment case vs running cash flow models. He said that “success on the stock market is an art and not a science”. The reason I really enjoy his writings is due to the historical perspective. Speculating in German government bonds in the 1940s, yes he has done it; being short in 1929, tick that box; speculating in wool in the 1940s, likewise. It’s very rare to read or listen to someone with 70+ years investing experience, and investing is a subject where experience is certainly important. Combined with his stories of famous bankers, investors, writers, musicians and witty one liners it’s no wonder his books (10+) sold millions of copies all over the world. But it’s unlikely that you’d have heard about him unless you live in continental Europe.Andre Kostolany was born in 1906 to an industrialist family in Budapest, Hungary as the youngest of four children. His family was very well known in the country and was close to Edward Teller or the Zwack family in Hungary to name a few. He studied philosophy and art history until one day one of his father’s investor friends based in Paris asked his father without any pretentiousness:“what would you like that child to become? A poet?! Send him to my office for real world experience, he'll learn a lot more". Andre Kostolany admitted that he was right. That’s how he moved to Paris, fell in love with the markets and began his life as a speculator. He has experienced a huge amount of volatility - successes and failures - and got wiped out on occasions early in his career, only to be bailed out by friends and associates. He chalked these lessons down to experience. One of the early lessons he learnt in the markets was basic supply and demand: “in the markets what matters is the relative size of the supply of paper [securities] to fools”.

Following the German invasion in 1940 he left Paris for New York, where he was based for the next 10 years. Prior to his escape he was asked about his political leaning and was often quoted saying that “my brain is to the right, my heart is to the left but my money is already in the US” [approx. $200k, which is a few $m in today's worth]. In the US he became the head and key shareholder of an investment company (Ballai and Cie Financing Company). After his time in the US he returned to Paris where he met his wife and settled down, although never had children. He was getting restless about the next steps of his life and upon the advice of a psychologist he began writing books on investing, markets, economics and personal anecdotes collected over a lifetime. I believe his published book count is well over 10 but none in English to my knowledge unfortunately (mostly in European and some Asian languages). He took on a major "celebrity status" after publishing his regular newspaper column (over 400 articles) in the German “Capital” magazine. He often appeared in German TV shows discussing current economic and market topics (watch from 5.40min mark for his definition of a crash). Kostolany split his time between Paris, Munich and the Cote d’Azur. To add to his many accomplishments he also founded a German investment company that is still around today.

His last wish was to be able to write the first article in the January 2000 edition of the Capital magazine. Unfortunately after a very long and colourful life he passed away in September 1999 at the age of 93 (you can read his obituary here). There is a very nice TV ad, which was shot in Budapest where he appears in. It’s a short video with an important life lesson at the end. Highly recommended to watch.

I’ve summarised some thoughts he had on investing, markets, economics and psychology and so on that I thought were interesting. You'll see that many of his views are actually very close to famous value investors':

- On optimism: “Those who don’t believe in miracles are not realists”, and “If I was young enough, say only 70, I’d found the school of optimists”, and “I don’t know what tomorrow brings, but with over 70 years of experience at least I know what happened yesterday and what’s happening today; most of my colleagues don’t even know that”

- On the value of money: “Money matters to me from only one perspective, it gives me independence. Independence means that if someone isn't convenient for me to meet I can tell them to take a hike. I don’t have a boss, employees, customers or clients whom I’ve to please. I’m an independent man"

- On the unpredictability of the stock market in the short term: “The relation between the stock market and the economy is like a man walking his dog. It is very difficult to determine the direction of the dog which will get easily distracted. The dog will sometimes sprint ahead, lag or just run around randomly but over time both the dog and the owner will get to the same place. While the owner walks 1km, the dog runs 3 to 4 times that. The dog is the stock market and the owner is the economy”

- On the weighing vs voting machine: “In the stock market it all depends on whether there are more fools than securities or more securities than fools"

- On being contrarian: "The short and mid term prospects of the stock market are 90% influenced by the psychology of the participants. The stock market is nothing else than the alternating movement of papers from the weak hands to strong hands. The market will behave differently depending if the securities are held by weak or strong hands. If the stock market doesn't react positively to good news, instead it falls the papers are held by weak hands. If it starts to rise regardless of bad news the papers are held by strong hands. If the stock market becomes a daily topic at parties, work, bus stops a crash is imminent. I can tell you that the more people approach me on the streets about the markets the more fearful I become"

- On success in the markets: "You need four things to be a successful speculator: (i) thought or an idea, (ii) belief or conviction, (iii) money and (iv) patience"

- How to invest and get wealthy in the markets: “I have stopped giving tips to others but if I can make a recommendation it would be that an investor should first go to a pharmacy and purchase large doses of sleeping pills. Upon the successful completion of that task they should acquire a portfolio of high quality securities then go to sleep for many years. Otherwise the inexperienced investor's emotions will be distracted by the market volatility"

- His recommendation for speculating in the market: “Anyone who has a lot of money to speculate should, who has little money should not and who has no money must”

- On success and failure: “49% of my speculations went wrong while I only acted correctly in the other 51%. The result is in the 2% difference”, and “On the stock market the most important thing is luck. I cannot attribute my success to intelligence but to luck. Of course I had ideas or visions from which I made money and also had less successful periods when I was losing but in the end the balance was positive”

- Successful speculations: “In 1946 I was buying German government bonds in US dollar, pound sterling and Swiss francs. Amongst these were 5.5% Young bonds issued in French francs, which at the time you could have bought for 25% of face value. I’ve loaded up on the bonds as I had the conviction that the first post-war Chancellor (Konrad Adanauer) would do everything to re-establish Germany’s credibility, which turned out to be right decision. These securities were revalued and bought out at 35,000 francs”

- On raising a family (he never had children): “If I’d have children, the first one must be a musician, the second a painter or sculptor, the third a writer or at least a journalist but the fourth must be a speculator to support the other three. The ability to see into the future can bring millions of dollars”

Weekend reading

Annual letters from Warren Buffett and Bill and Melinda Gates

How Super Angel Chris Sacca Made Billions, Burned Bridges And Crafted The Best Seed Portfolio Ever (Forbes)

How the Panama Canal Got Its Groove Back (Priceonomics)

How Super Angel Chris Sacca Made Billions, Burned Bridges And Crafted The Best Seed Portfolio Ever (Forbes)

China’s state-owned zombie economy (FT)

Reforming a sector burdened by debt and overcapacity is critical to restoring growth in the economy

Macro Roundtable on China (SumZero)

Creating Effective Incentive Systems: Ken Iverson on the Principles that Unleash Human Potential (Farnam Street)

CAPE Strategy Update (Minority Report)

LEVERAGE, FLEXIBILITY & OPPORTUNITY (Cook and Bynum)

A Crisis In Ponzi-Land (The "Drop-Down”) (Part III in Kuppy’s MLP series; Adventures in Capitalism)

Weitz - Valuable Losses (Wealthtrack)

A rare interview with Great Value Investor Wally Weitz on finding opportunities where others are seeing losses

The Road Less Traveled: Special Situations Investing (Value Walk)

Great presentation on how to find special situations ideas from Buckley Capital

Douglas Coupland: The rise and fall of the mall (FT)

Recalling the golden age of the shopping mall and why we may look back on the 1990s as the last good decade

BIG AGRICULTURE GETS ITS SH*T TOGETHER (Fortune)

A huge U.S. dairy is tackling the farm pollution problem by turning cow manure into fuel. Will others follow suit?

A huge U.S. dairy is tackling the farm pollution problem by turning cow manure into fuel. Will others follow suit?

Here's a whole year's worth of weather in one video (Science Alert)

We all know that 2015 was the hottest year on record. But what did that look like exactly? Thanks to all the handy satellites stationed around Earth we now have the ability to watch our weather 24/7 from space. And that also gives us the chance to take a broader perspective and look back on the year that was, thanks to this beautiful time-lapse from weather monitoring organisation EUMETSTAT.

We all know that 2015 was the hottest year on record. But what did that look like exactly? Thanks to all the handy satellites stationed around Earth we now have the ability to watch our weather 24/7 from space. And that also gives us the chance to take a broader perspective and look back on the year that was, thanks to this beautiful time-lapse from weather monitoring organisation EUMETSTAT.

Saturday 20 February 2016

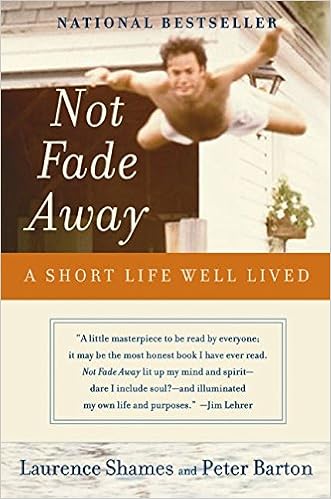

Not Fade Away Book Review and My Story

Just a heads up that this is a very personal post, with limited relevance to investing. Proceed at your own risk.

This book has to be one of the most moving ones I read in a while and thought it was worth writing a review with some of my personal reflections as well. The recommendation originally comes from Tim Ferriss' interview on his podcast with Chris Sacca. Chris is a VC but has taken a different approach to the traditional way of doing things and his portfolio includes a number of companies that turned out to be unicorns (his interview and story are worth checking out).

Back to the book. The story is about Peter Barton whom along with John Malone completely changed the cable industry. Peter was part of the baby boom generation and accredits his growing up in this era, where kids weren't pressured to become astrophysicists at age 5, to much of his success in life. He has been an all around bon vivant, musician, self-described ski-bum, Columbia University student, political campaign strategist, working in politics and eventually going to work for John Malone as his right-hand man turning the cable industry inside out and retiring in 1997 at the age of 46 to spend time with his family. Except life had other plans...he passed away in 2002.

Back to the book. The story is about Peter Barton whom along with John Malone completely changed the cable industry. Peter was part of the baby boom generation and accredits his growing up in this era, where kids weren't pressured to become astrophysicists at age 5, to much of his success in life. He has been an all around bon vivant, musician, self-described ski-bum, Columbia University student, political campaign strategist, working in politics and eventually going to work for John Malone as his right-hand man turning the cable industry inside out and retiring in 1997 at the age of 46 to spend time with his family. Except life had other plans...he passed away in 2002.

He was diagnosed with stomach cancer, which after a while seemed to have been cured, however it unfortunately came back in a terminal version one year later. During the last period of his life Peter got together with writer Laurence Shames to put all of his life and experiences on paper, which resulted in this gem of a book. At first he was reluctant to get involved in this project: "I tried my damnedest not to get involved in the writing of this book, or with a man named Peter Barton, whose life it celebrates and whose death it chronicles. My reason for resisting was simple: My own small existence was on a very pleasant, even keel; I didn't want to disrupt it by getting close a dying stranger. I didn't want to think about mortality, still less watch death happening from day to day. I didn't want to grow to care about a family that would soon be fatherless". Fortunately for the readers he did get close and wrote this wonderful book.

Instead of going through the whole book I thought to take out a few parts and lessons that stuck with me the most as I was reading it. You can read about Peter Barton's life in his obituary.

"Funeral Test" (i.e. whoever has the biggest funeral wins): "The official recognition [of Peter's achievements] was impressive...and yet it seemed oddly impersonal, beside the point. Peter would have been more pleased, I think, to see the hundreds of friends who rallied around his family. Kids he'd coached, or taken along on his Real World Outings. Colleagues he'd advised and schemed with. Neighbors whose dogs had gotten muddy alongside Peter's dogs. People he'd skied with, or biked with, or with whom he'd sat around the piano and jammed and wailed. More than fifteen hundred of these friends and colleagues and acquaintances turned out for Peter's memorial - an event intended not for mourning but for celebration. There was a gospel choir, and a children's choir in which Kate [his daughter] sang. There was food and wine. There was a stitched together video of Peter's life, accompanied - of course! - by a rock'n'roll soundtrack. And there were speeches. In keeping with the spirit of the evening, the speakers passed lightly over the subject of Peter sick and dying, still seeking meaning in the face of pain and honest doubt. Instead, they spoke of Peter in his glory. Peter, who believed that nothing was impossible. Peter, who could step into a situation, overwhelmed but never daunted, and master it. Peter who skied too fast, drove too fast, worked too hard, and made it all look easy."

Finding the right spouse: "Relationships had been one of those aspects of life in which I made things harder for myself, was too feisty for my own good. I'd waffled on commitment. I'd sometimes been unkind by simple inattention, being too wrapped up in other things. I don't think I'd ever truly let someone into my life. I was also saddled with the odd and macho notion that a man needed different sorts of woman at different ages. [...] What I was too dumb to realize, of course, was that if you were lucky enough to meet the right woman, she was all of those things and more - and the two of you evolved together. When I met Laura [his wife] I finally started to understand that. And thank God I did. [...] Previously, if there were difficulties, rough patches in relationships, I walked. Now we worked things out. Previously, I did things my own way, by reflex. Now I was willing to pause, to see the wisdom in Laura's way. It was crucially important to me to get this right, because I had the absolute conviction that if Laura and I started a family, we would stay together forever."

It's not all about the money: "It was a messy beginning, but CVN really took of. Within two years it was a billion-dollar business with forty-six hundred employees. But I'm a start-up guy by temperament, and by then I was tired of running it. The only way to make a graceful exit was to merge the company with another recent start-up called QVC. At this point I could finally sit still long enough to consider my stock options. I saw what they were worth - three million bucks, a million and a half after taxes! - and cashed them in at once. Now, some people might say that a million and a half dollars is not a lot of dough, but to me it was that most elusive amount: enough. Enough so that I was confident my wife and kids would be secure. Enough so that everyone would have a home and tuitions would be paid. Enough so that if I dropped dead tomorrow, everyone would be okay. I was over the hump. I could do right as a father. I was thirty-eight when that money came to me. More money has come as money does; it takes on a momentum of its own. But the rest has been Monopoly dough, just a way of keeping score."

Teaching kids about the world beyond school: "Just as it's crucial for underprivileged kids to be shown that there are possibilities beyond their neighbourhoods, it's also important for overprivileged kids to see other sides of life. I didn't want my kids to grow up in an abstract world of deals and numbers and money that just happened. I wanted them to understand that people worked hard, at a gloriously wide range of things, and that there was dignity in all of them. So I bought a big stretch van - my rolling locker room - and started taking my kids and their friends on what I thought of as Real World Outings. They were like school field trips, but without the onus of school. I was never "Mr. Barton". I was always Peter. [...] Every outing had a theme. "Grease" - where we looked at the realities of fast food. "Garbage" - where we followed the trail of household trash, and of recycled cars and asphalt and concrete. [...] Sometimes, at the end of our outings, there'd be the strangest sound in the van: silence. How rare was that? Ten or twelve kids, thinking something over."

Oh and a practical one about job applications: [after finishing his MBA] "As a matter of personal preference and quality of life, I would only work in Boston, San Francisco, or Denver. Well, with all those conditions I was clearly limiting my options. But I did my homework, and I came up with a list of possible employers. I started with a personal Who's Who of 231 names and sent each of them a letter [offering to work for free for a period]. Amazingly, 123 CEOs responded. For various reasons, that group was gradually whittled down to three possibilities in Denver. There was a hippy tea company and two-cable television outfits. The tea people didn't really want me, and of the cable companies was already top-heavy with MBAs. That left a dinky little outfit called TCI, which was headed by a seat-of-the-pants, feet-on-the-desk visionary named John Malone. From our very first conversation I realized that Malone was the guy I wanted to work for. He thought huge. He was informal, original, and totally audacious."

And one last quote in closing: "If I have anything at all to teach about life, it probably comes down to these two simple but far-reaching notions: Recognizing the difference between a dumb risk and a smart one, and understanding when you need to change direction, and have the guts to do it."

My Story

I'm always fascinated with the next chapter after our lives and books like these or Bronnie Ware's actually help reduce the fear, at least for me. Don't get me wrong it's not something I'm seeking out actively but there was a period in my life when I had to face it, very fortunately my story turned out better than Peter's.

Let me explain. Many years ago I was diagnosed with an advanced stage cancer, fortunately however it was entirely treatable. I still remember learning about it at first. I was in my car and everything around me has seemed to have slowed down with an odd sense of quietness that to this day I cannot describe. At first you go through phases of denial (i.e. I'm way too healthy, way too young, and so on) and then you realise that there are no ways around it, only through it. Over the next few weeks I've read everything I could get my hands on about what this is, what's involved in terms of the treatment, side effects but nothing can prepare you for the shock that you are going to experience.

The physical pain and side effects are one thing, however what's tougher is dealing with your own psychology. I'll spare you all the horrors about the first part, however the second is worth exploring a bit. I've realised that it's not until you accept that you have this illness you can face it head on, and the earlier you accept the better. Once your mind is fully on board you've conquered yourself and your fear, which is half the battle as they say. I mean it. I've experimented with different approaches to going through treatment days but what always worked is going to the hospital in the right state of mind (i.e. that this can be cured and I'll do my best to do it). This was a game changer. At the very beginning there were days when I just couldn't bring myself to be fully functional and that was trouble. A standard one day treatment would take two days, there would be complications, pain and so on, so these experiences served as a good guidepost that no matter what you just cannot give up. Perhaps the saddest part that I had to experience and see first hand is children and the elderly having to go through this pain and sometimes having the worst outcome. It's just simply unfair and terrible to see the vulnerable go through this but you've to block these events out otherwise they'll overwhelm your mind.

I'd share one short story from that year. I came to the very end of the treatment, however unfortunately I wasn't yet fully cured. This was hugely negative as I was completely exhausted by the end. The doctors (to whom I'm eternally grateful) suggested more and stronger treatment, but as they say doing the same thing over and over again and expecting different results is insanity. I thanked them for their help and guidance but politely declined and took three peaceful months off from everything. I went with my gut and experienced a strange sense of calmness. At the end of the third month a regular check-up showed that I was fully healed. Cancer treatment puts a huge amount of stress on your body (it's why people lose their hair for instance) and somewhere deep down I knew that ultimately doing more of the same wasn't the right answer. I would have only gotten weaker or who knows what would have happened. The downside to this three month break would have been a few months delay in this treatment if things didn't turn out for the better. Sometimes your gut already knows what's best for you, you just have to listen to it. Since then I'm watching my health like a hawk, sometimes driving doctors crazy.

Extreme events in life have a tendency to reduce the fear we experience and it is no different for me. Your worst case scenario (i.e. what's the worst that can happen if I do ABC) shifts drastically. Interestingly it didn't make me believe that I'm infallible, but more rational I'd say and grateful for all the opportunities I got since. Life just snowballs for the better once you let go.

I've been thinking throughout the years the lessons I've learned from this experience and over time have whittled it down to four that I'd like to share that might be helpful if you find yourself in a tough spot:

I highly recommend this book for anyone interested about life (and death), how to pack a lot into a short life, business and many other topics. Reading this will make you cry, if not then there is probably something wrong with you. As I was reading more and more about Peter I came across a great two hour interview with him that is just full of wisdom and great insights, highly recommend watching that too (also great insights into the early days of TCI and John Malone)!

Additionally, here is an insightful interview with author Laurence Shames on his experience of writing this book.

All the quotes are sourced from: Not Fade Away: A Short Life Well Lived by Laurence Shames and Peter Barton (Amazon)

This book has to be one of the most moving ones I read in a while and thought it was worth writing a review with some of my personal reflections as well. The recommendation originally comes from Tim Ferriss' interview on his podcast with Chris Sacca. Chris is a VC but has taken a different approach to the traditional way of doing things and his portfolio includes a number of companies that turned out to be unicorns (his interview and story are worth checking out).

Back to the book. The story is about Peter Barton whom along with John Malone completely changed the cable industry. Peter was part of the baby boom generation and accredits his growing up in this era, where kids weren't pressured to become astrophysicists at age 5, to much of his success in life. He has been an all around bon vivant, musician, self-described ski-bum, Columbia University student, political campaign strategist, working in politics and eventually going to work for John Malone as his right-hand man turning the cable industry inside out and retiring in 1997 at the age of 46 to spend time with his family. Except life had other plans...he passed away in 2002.

Back to the book. The story is about Peter Barton whom along with John Malone completely changed the cable industry. Peter was part of the baby boom generation and accredits his growing up in this era, where kids weren't pressured to become astrophysicists at age 5, to much of his success in life. He has been an all around bon vivant, musician, self-described ski-bum, Columbia University student, political campaign strategist, working in politics and eventually going to work for John Malone as his right-hand man turning the cable industry inside out and retiring in 1997 at the age of 46 to spend time with his family. Except life had other plans...he passed away in 2002.He was diagnosed with stomach cancer, which after a while seemed to have been cured, however it unfortunately came back in a terminal version one year later. During the last period of his life Peter got together with writer Laurence Shames to put all of his life and experiences on paper, which resulted in this gem of a book. At first he was reluctant to get involved in this project: "I tried my damnedest not to get involved in the writing of this book, or with a man named Peter Barton, whose life it celebrates and whose death it chronicles. My reason for resisting was simple: My own small existence was on a very pleasant, even keel; I didn't want to disrupt it by getting close a dying stranger. I didn't want to think about mortality, still less watch death happening from day to day. I didn't want to grow to care about a family that would soon be fatherless". Fortunately for the readers he did get close and wrote this wonderful book.

Instead of going through the whole book I thought to take out a few parts and lessons that stuck with me the most as I was reading it. You can read about Peter Barton's life in his obituary.

"Funeral Test" (i.e. whoever has the biggest funeral wins): "The official recognition [of Peter's achievements] was impressive...and yet it seemed oddly impersonal, beside the point. Peter would have been more pleased, I think, to see the hundreds of friends who rallied around his family. Kids he'd coached, or taken along on his Real World Outings. Colleagues he'd advised and schemed with. Neighbors whose dogs had gotten muddy alongside Peter's dogs. People he'd skied with, or biked with, or with whom he'd sat around the piano and jammed and wailed. More than fifteen hundred of these friends and colleagues and acquaintances turned out for Peter's memorial - an event intended not for mourning but for celebration. There was a gospel choir, and a children's choir in which Kate [his daughter] sang. There was food and wine. There was a stitched together video of Peter's life, accompanied - of course! - by a rock'n'roll soundtrack. And there were speeches. In keeping with the spirit of the evening, the speakers passed lightly over the subject of Peter sick and dying, still seeking meaning in the face of pain and honest doubt. Instead, they spoke of Peter in his glory. Peter, who believed that nothing was impossible. Peter, who could step into a situation, overwhelmed but never daunted, and master it. Peter who skied too fast, drove too fast, worked too hard, and made it all look easy."

Finding the right spouse: "Relationships had been one of those aspects of life in which I made things harder for myself, was too feisty for my own good. I'd waffled on commitment. I'd sometimes been unkind by simple inattention, being too wrapped up in other things. I don't think I'd ever truly let someone into my life. I was also saddled with the odd and macho notion that a man needed different sorts of woman at different ages. [...] What I was too dumb to realize, of course, was that if you were lucky enough to meet the right woman, she was all of those things and more - and the two of you evolved together. When I met Laura [his wife] I finally started to understand that. And thank God I did. [...] Previously, if there were difficulties, rough patches in relationships, I walked. Now we worked things out. Previously, I did things my own way, by reflex. Now I was willing to pause, to see the wisdom in Laura's way. It was crucially important to me to get this right, because I had the absolute conviction that if Laura and I started a family, we would stay together forever."

It's not all about the money: "It was a messy beginning, but CVN really took of. Within two years it was a billion-dollar business with forty-six hundred employees. But I'm a start-up guy by temperament, and by then I was tired of running it. The only way to make a graceful exit was to merge the company with another recent start-up called QVC. At this point I could finally sit still long enough to consider my stock options. I saw what they were worth - three million bucks, a million and a half after taxes! - and cashed them in at once. Now, some people might say that a million and a half dollars is not a lot of dough, but to me it was that most elusive amount: enough. Enough so that I was confident my wife and kids would be secure. Enough so that everyone would have a home and tuitions would be paid. Enough so that if I dropped dead tomorrow, everyone would be okay. I was over the hump. I could do right as a father. I was thirty-eight when that money came to me. More money has come as money does; it takes on a momentum of its own. But the rest has been Monopoly dough, just a way of keeping score."

Teaching kids about the world beyond school: "Just as it's crucial for underprivileged kids to be shown that there are possibilities beyond their neighbourhoods, it's also important for overprivileged kids to see other sides of life. I didn't want my kids to grow up in an abstract world of deals and numbers and money that just happened. I wanted them to understand that people worked hard, at a gloriously wide range of things, and that there was dignity in all of them. So I bought a big stretch van - my rolling locker room - and started taking my kids and their friends on what I thought of as Real World Outings. They were like school field trips, but without the onus of school. I was never "Mr. Barton". I was always Peter. [...] Every outing had a theme. "Grease" - where we looked at the realities of fast food. "Garbage" - where we followed the trail of household trash, and of recycled cars and asphalt and concrete. [...] Sometimes, at the end of our outings, there'd be the strangest sound in the van: silence. How rare was that? Ten or twelve kids, thinking something over."

Oh and a practical one about job applications: [after finishing his MBA] "As a matter of personal preference and quality of life, I would only work in Boston, San Francisco, or Denver. Well, with all those conditions I was clearly limiting my options. But I did my homework, and I came up with a list of possible employers. I started with a personal Who's Who of 231 names and sent each of them a letter [offering to work for free for a period]. Amazingly, 123 CEOs responded. For various reasons, that group was gradually whittled down to three possibilities in Denver. There was a hippy tea company and two-cable television outfits. The tea people didn't really want me, and of the cable companies was already top-heavy with MBAs. That left a dinky little outfit called TCI, which was headed by a seat-of-the-pants, feet-on-the-desk visionary named John Malone. From our very first conversation I realized that Malone was the guy I wanted to work for. He thought huge. He was informal, original, and totally audacious."

And one last quote in closing: "If I have anything at all to teach about life, it probably comes down to these two simple but far-reaching notions: Recognizing the difference between a dumb risk and a smart one, and understanding when you need to change direction, and have the guts to do it."

My Story

I'm always fascinated with the next chapter after our lives and books like these or Bronnie Ware's actually help reduce the fear, at least for me. Don't get me wrong it's not something I'm seeking out actively but there was a period in my life when I had to face it, very fortunately my story turned out better than Peter's.

Let me explain. Many years ago I was diagnosed with an advanced stage cancer, fortunately however it was entirely treatable. I still remember learning about it at first. I was in my car and everything around me has seemed to have slowed down with an odd sense of quietness that to this day I cannot describe. At first you go through phases of denial (i.e. I'm way too healthy, way too young, and so on) and then you realise that there are no ways around it, only through it. Over the next few weeks I've read everything I could get my hands on about what this is, what's involved in terms of the treatment, side effects but nothing can prepare you for the shock that you are going to experience.

The physical pain and side effects are one thing, however what's tougher is dealing with your own psychology. I'll spare you all the horrors about the first part, however the second is worth exploring a bit. I've realised that it's not until you accept that you have this illness you can face it head on, and the earlier you accept the better. Once your mind is fully on board you've conquered yourself and your fear, which is half the battle as they say. I mean it. I've experimented with different approaches to going through treatment days but what always worked is going to the hospital in the right state of mind (i.e. that this can be cured and I'll do my best to do it). This was a game changer. At the very beginning there were days when I just couldn't bring myself to be fully functional and that was trouble. A standard one day treatment would take two days, there would be complications, pain and so on, so these experiences served as a good guidepost that no matter what you just cannot give up. Perhaps the saddest part that I had to experience and see first hand is children and the elderly having to go through this pain and sometimes having the worst outcome. It's just simply unfair and terrible to see the vulnerable go through this but you've to block these events out otherwise they'll overwhelm your mind.

I'd share one short story from that year. I came to the very end of the treatment, however unfortunately I wasn't yet fully cured. This was hugely negative as I was completely exhausted by the end. The doctors (to whom I'm eternally grateful) suggested more and stronger treatment, but as they say doing the same thing over and over again and expecting different results is insanity. I thanked them for their help and guidance but politely declined and took three peaceful months off from everything. I went with my gut and experienced a strange sense of calmness. At the end of the third month a regular check-up showed that I was fully healed. Cancer treatment puts a huge amount of stress on your body (it's why people lose their hair for instance) and somewhere deep down I knew that ultimately doing more of the same wasn't the right answer. I would have only gotten weaker or who knows what would have happened. The downside to this three month break would have been a few months delay in this treatment if things didn't turn out for the better. Sometimes your gut already knows what's best for you, you just have to listen to it. Since then I'm watching my health like a hawk, sometimes driving doctors crazy.