Minor (MINT:TB) is a Thai listed hotel and food business operator with an excellent track record. I’ve been keeping track of the stock for the last few years mostly as a spectator, for which I’ve been kicking myself but that’s beside the point. The company was formed in the late 1970s by an American businessman (now Thai citizen) Bill Heinecke, who took a $1,200 loan and over time turned it into MINT. As a fun fact, the company is called Minor as Mr Heinecke (who owns 33%, c. $1.5bn value) was still a minor when he founded it. While he is relatively unknown outside of Thailand/SE Asia his story is pretty remarkable. After the write up there are a few links to profiles, interviews and he also has a good book about entrepreneurship that I recommend reading.

History

MINT consists of three businesses: hotel (51% of revenue), food (41% of revenue) and retail (8%) and prior to two corporate restructurings operated with three separately listed entities, coupled with cross-holdings in true Asian conglomerate style (see structure below):

- Royal Garden Resorts (Minor International since 2005) was founded in 1978 with one hotel on the Pattaya beachfront (now Pattaya Mariott Resort & Spa) and listed in 1988

- Minor Food Group (MFG) was founded in 1980, with one Pizza Hut. This business grew to introduce other Western franchise concepts in Thailand (Swensen, Sizzler, BK, Dairy Queen and so on). Ultimately, Minor lost the Pizza Hut franchise and in “retaliation” formed the Pizza Company (now it’s a larger franchise in the country than Pizza Hut)

- Minor Corp, which houses the retail business (stores of Espirit, Gap, Tumi etc) in Thailand, was listed in 1991

The first of the consolidations was in 2005 when MINT closed the acquisition process of MFG it started in 2001 (MFG’s results have been consolidated since 2004), which lead to the re-branding of RGR to MINT in 2005. Then in the middle of the financial crisis MINT announced that it planned to acquire Minor Corp and unwind the cross-holdings in an all-share deal. Following these restructurings, MINT now houses all three businesses and Mr Heinecke, who is the chairman and CEO, and his group owns 33% of the company. Below is a summary of MINT’s major moves over its history to date.

Source: Company filings

MINT has been a clear beneficiary of smart capital allocation as well as the growth in SE Asia. Since 2005 to date the share price compounded c. 24% (TSR in THB); revenue and EBITDA grew 16% p.a. and 14% p.a., respectively; while ROIC averaged 18%. Current market cap is $4.6bn (EV $5.8bn) and trades on forward EBITDA of 18x and PE of 26x, respectively so it is hard to call the stock cheap statistically.

Source: Bloomberg. Share price and TSR (THB)

Businesses

What’s key for MINT are the brands it built around the hotel, food and retail businesses over the last 20+ years. Essentially these avenues allow mgmt. to reinvest capital at very high rates, with the added benefit that some of these brands “travel”. Oftentimes you find a brand, such as Tingyi’s Master Kong in China, which is the dominant one in the country but doesn’t travel well outside of the country thus the company is restricted to its home market. Now you could argue that when you rule the noodle empire in China, why would you want to go elsewhere. If the company in question is based in a smaller market or country which is saturated, expansion and brands that travel i.e. having some form of a platform, becomes very important. MINT has historically partnered with leading global brands (see Pizza Hut, Four Seasons etc) but has never been shy to apply lessons learnt from these partnerships to develop their own businesses over time (e.g. Pizza Co or Anantara). The other interesting part is that generally speaking MINT’s existing and new investments are in countries along the new Maritime Road (from China’s OBOR), which is taking everything at face value is not a terrible thing.

Hotel Business

The hotel business (previously RGR) started with one hotel in Thailand. As of 2015 it has 138 properties and over 17,000 rooms (inc. majority owned, JVs and management letting rights and managed) globally. Over the last few years this business contributed 50% to revenues and 60% to EBITDA on average.

Source: Company filings

MINT follows an “asset-right” strategy, which is a combination of direct hotel ownership as well as management contracts. Generally speaking, when the company enters a new market it starts out with management contracts to establish itself. Once it feels more comfortable, it would form a JV with a local partner and then finally own the assets outright. This is the strategy the company followed when the balance sheet was fairly levered before or when it recently entered Africa.

Source: Company filings

Of the existing 138 properties, 30 are purely managed, 49 are under management letting rights (Oaks business, serviced suites in Australia and New Zealand), 30 are in different JVs while 29 are majority owned.

The majority owned hotels contribute 45% to revenues, with nearly 5,400 rooms globally with brands such as Anantara (developed by MINT), Four Seasons, Marriott or St Regis. The most recent addition to the portfolio was Tivoli (hotel operator in Portugal and Brazil with 4-5 star properties). MINT acquired the business to use it as a platform to expand in Europe, LatAm and certain parts of Africa. The acquisition price was €290m or $330m for 2,982 rooms ($110k/key on average) or 9.6x EBITDA (MINT notes normalised 2015 EBITDA of €30m), which is neither expensive nor cheap. Local contacts confirm that the hotels are very good but nothing out of the ordinary.

The Oaks business (management letting rights) contributes 25% to revenues and is a business MINT acquired in 2011 in a bid to increase the company’s asset-light earnings stream. Oaks was under financial stress at the time due to leverage so the purchase was rather opportunistic. The all-in price was around $95m with 2011 EBITDA guidance of $35-40m. Since 2012 (first full year of consolidation) revenues increased c. 50% through 2015. The business now includes over 6,200 rooms in Australia, New Zealand and UAE.

Real estate business (Anantara Vacation Club and residential sales) add c. 20% to revenues and include the development of properties either for sale (the residential part) or a timeshare/lifestyle club (AVC). Currently, AVC has 6,900 members (majority from China) and 137 units in inventory.

Hotel management and JVs contribute around 5% to revenues each on average and include around 30 hotels (over 3,900 rooms) and 30 hotels (over 1,200 rooms), respectively.

The below slide gives an overview of the expansion plans, additionally the company plans to invest to increase it’s residential as well as AVC inventory.

Source: Company filings

Food Business

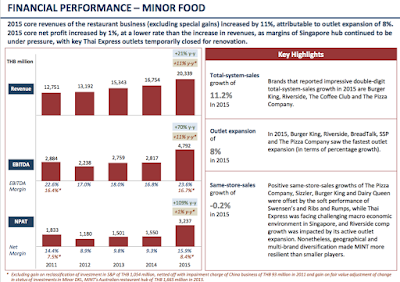

As noted above the food business has been consolidated since 2005 and it contributes c. 40% to revenues and 30% to EBITDA on average. It is a more stable business and acts as the cash cow to fund the hotel/real estate growth. It includes over 20 brands (The Pizza Co, Sizzler, BK, DQ, Thai Express etc) and over 1,800 restaurants that are either owned or franchised (roughly 50/50). In fact, MINT was one of the first companies in Thailand to introduce the QSR concept. Since 2005 segment revenues increased 4x and the company operates in four hubs: Thailand, Singapore, Australia and China. The below two charts give a good glimpse as to what’s in this business. MINT plans to increase the restaurant count by 70% from 2015 through 2020. While segment revenues have grown over the years due to the expansion of outlets the concerning part is the declining SSSG.

Source: Company filings

Source: Company filings

Last but not least the retail business is about 9% of revenues and 3% of EBITDA on average, and includes retail outlets with brands such as the Gap, Espirit, Bossini as well as contract manufacturing of FMCG. As of 2015 the business has 269 fashion, 16 cosmetic and 22 household outlets.

Financials

Below is a selection of key financials for your perusal but I’d bring your attention to a few items:

- Leverage: It’s high. Currently net debt/EBITDA and EBIT are around 4x and 5.5x with the average over the period being approx. 1x lower. This is the result of the breakneck speed growth. While it’s high it is not unmanageable and if the company stopped investing in growth it could technically begin to repay it

- Share count: The reason while leverage is not higher is due to share issuance over the years. Since 2005 the diluted share count increased by 5% p.a., due to issuance for M&A, options, stock dividends (most recently in 2015) or warrants. While net income increased 21% p.a., EPS increased by “only” 15% p.a. as result of dilution

- Free cash flow: MINT has been largely free cash flow positive only including investment in PPE. Accounting for additional investments and M&A the picture is slightly different. However, have to say that looking at the history (e.g. Oaks) most of them turned out to be accretive investments

- Dividend: MINT paid out roughly 35% of net income as dividend (either cash or in-kind), while DPS compounded 11% over the years. The current yield is about 1%

- Margins: Net, EBIT and EBITDA margins averaged 11%, 15% and 23% over the last ten years and generally speaking have been relatively stable

- Returns: ROIC averaged 18% and you can see a recovery from 2011 onwards due to a shift towards a more balanced “asset-right” strategy

Source: Company filings. Dividend payout refers to average payout

Valuation

MINT is currently going through a transformation and growth phase (some say it has never been on a different one) both in its businesses as it focuses on organic growth as well as M&A, diversifying further away from its base in Thailand. Per the company’s estimate this should translate to 15-20% average p.a. growth in net income over the next five years with ROIC of over 15%.

Source: Company filings

I’m not a big fan of five year plans, mostly for the reason that nobody knows what will happen by year five and from experience with boards and managements these plans are by and large missed. What I look at instead is track record – how did a company do in various economic and political scenarios. It tells a lot about management’s ability and the company’s resilience. For MINT, given the volatility of Thailand (plenty of coups for a relatively peaceful country) it is rather easy to see. While one-off events have impacted results the company has grown right through them over the long term.

Source: Company filings

As noted above the multiples are quite rich and the highest they have ever been, well above their historical average levels. In fact, a large part of the share price performance was driven by the re-rating of the multiples which you can see below.

Source: Bloomberg

Source: Bloomberg

While I rarely come across formal guidance from Asian listed businesses, the below two charts are as far as I’ve see any go. MINT is essentially saying that their plan (and again note the above caveat) is to increase the 2015 THB7bn net income (note it includes a large write-up) by call it 80-100% over the next five years (it’s roughly a 15% CAGR).

Source: Company filings

Additionally, the chart below shows MINT’s capex requirements (the bars) and EBITDA coverage. If you take the 2020 committed capex of around THB5.5bn and the guided coverage of 4x, it would imply THB22bn EBITDA vs the THB11bn in 2015 (i.e. the same sort of growth rate as net income).

If you put the forward P/E and EBITDA multiples on these figures, assume no further dilution and discount it today, the per share value could be around THB55-60 or 50-60% higher than compared to current.

Source: Company filings

Another way to look at it is to run cash flows with different growth rates. At present I believe the market is pricing an 8-9% p.a. increase in EBITDA and FCF vs the 15% p.a. as above so you’ve a range for the valuation and what you believe the appropriate growth rate is. MINT is arguably one of the best compounding machines around but I’d say that to get to their valuation range many things have to go right in terms of timing and execution. It is not far-fetched at all (judging by track record) and if one believes in the “platform” value of MINT, i.e. the multiples of avenues for reinvestment, which has been historically demonstrated, it is certainly plausible.

I’ve been thinking about what’s the genius of Mr Heinecke. He doesn’t strike me as an “outsider” type from a financial engineering or capital allocation perspective but more so as a brand builder or entrepreneur (like Mr Branson less the hot air balloons). Mr Heinecke has been a clear beneficiary of the EM growth (particularly Thailand) but also had the savvy to build out these great platforms (sometimes opportunistically) with solid brands.

Alternative Ways of Investing in MINT

MINT is primarily traded in Thailand and there are a few illiquid ADRs here and there but largely not worth your time. If you looked carefully at the list of shareholders you’ll find that a large chunk of shares are held by Symphony International (SIHL). I

wrote about this stock briefly a while ago but thought it would be worthwhile to circle back.

SIHL is a closed end fund listed in London, with its largest holding as MINT. They hold an 8% stake ($350m value), while the key person behind SIHL/chairman of the GP is also on the board of MINT. As of December 2015 the SIHL NAV is around $700m so clearly MINT is a substantial holding for the fund. Diluted NAV per share is $1.3 per share (shares trade in $); listed investments make up $0.9/sh, unlisted investments c. $0.3/sh with $0.1/sh in temporary investments, trading at an approx. 40% discount to NAV (not terribly different from historicals). Now for the famous “what are you getting for free”: if you back out the unlisted investments and cash you are still getting the listed investments at a discount.

But it begs the question why is there such a discount? To put this into context: SIHL went public in 2007 at $1/sh while the current price is $0.75/sh…clearly a very different story compared to MINT. I wrote about the reasons in the past but it’ll be a combination of the management fees, capital allocation, ill-timed rights issue, substantial options granted to the manager and limited inclination to do anything about the discount. On the upside there are the 2017 clause to distribute 80% of the NAV as well as a few large shareholders who have been active and could be further catalysts for the closing of the discount.

Further Resources

Bill Heinecke Amazon Author Page

DealBook Profile

Bloomberg Profile

Bloomberg Video Interview

CNBC Video Interview

Investor Q&A after the 2014 Results

MINT 2015 IR Presentation

SIHL's Investments

SIHL’s 2015 Annual Report